In episode 192 of the Disruptors for GOOD podcast, I speak with Jake Wood, Founder and CEO of Groundswell, on disrupting corporate philanthropy and workplace giving through Donor Advised Funds.

Listen on Spotify.

Listen on Apple Podcasts.

Listen to more Causeartist podcasts.

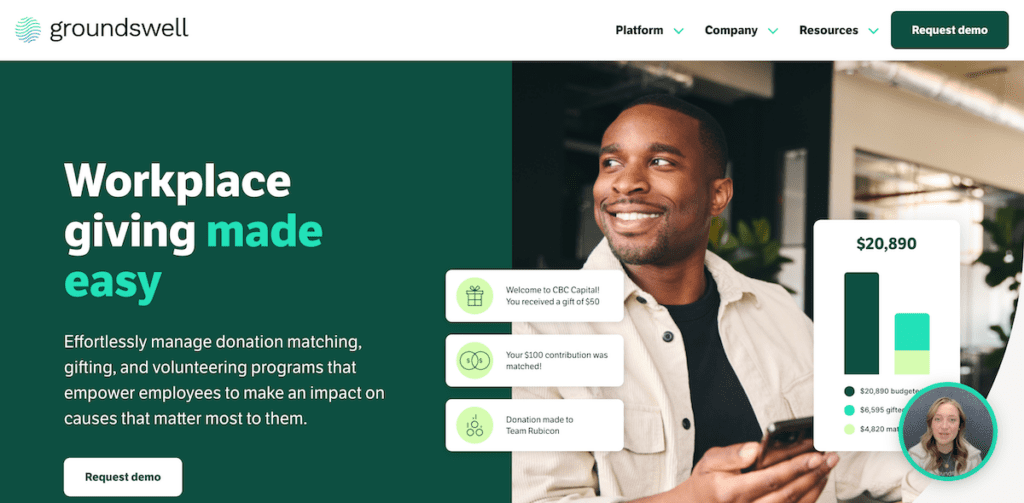

Workplace giving programs are an excellent way for companies to empower employees to make a positive impact on causes they care about.

However, managing these programs efficiently can be time-consuming and challenging. That’s where Groundswell comes in.

With its user-friendly platform, Groundswell simplifies donation matching, gifting, and volunteering programs, allowing employees to effortlessly contribute to the causes that matter most to them.

About Jake Wood

Jake Wood is a former U.S. Marine and the founder and CEO of Groundswell, a venture-backed software company focused on democratizing philanthropy by combining fintech, benefits tech, and charity.

Prior to Groundswell, Wood was the founder and CEO of Team Rubicon, a renowned disaster response organization.

Under his leadership, Team Rubicon grew to become one of America’s leading nonprofits, recruiting over 150,000 volunteers and responded to nearly 1,000 disasters and humanitarian crises

Wood also played a significant role in raising approximately $300 million for Team Rubicon through various means, including online donor acquisition, family foundations, and corporate partnerships.

The organization scaled to 200 full-time employees across four offices and operated a $55 million P&L. Team Rubicon gained recognition for its corporate culture and technological innovation through collaborations with companies like Microsoft, Twilio, and Palantir.

Furthermore, his memoir, “Once A Warrior,” achieved best-seller status on Amazon and received praise from Tom Brokaw.

Groundswell Features

Streamlined Management

No more administrative burdens. Say goodbye to hours spent collecting donation receipts, vetting charities, and tracking volunteer hours.

Groundswell takes care of all the busy work, freeing up your time to focus on making a meaningful impact on your employees. By providing them with their own personal foundation powered by a donor-advised fund, the platform ensures a hassle-free setup process.

Quick and Easy Setup

Unlike other platforms, Groundswell expedites the setup process, allowing you to launch your program in record time. With Groundswell, you can start making a difference in hours, not months.

Insights and Reporting

Understanding the causes your employees care about is vital for creating a company-wide impact. The platform provides valuable insights into your employees’ philanthropic preferences and enables you to generate comprehensive reports on your giving program’s effectiveness.

This data-driven approach helps you make informed decisions and showcase your company’s positive contributions.

Valuable Program Resources

Searching for suitable charities and resources can be time-consuming. Groundswell simplifies the process by offering a centralized platform where you can find valuable resources related to key issue areas.

Spend less time researching and more time making a difference during crucial moments.

Effortless Program Management

Whether it’s employee matching, gifting, or volunteering, Groundswell has got you covered. Simply provide your employee list and corporate giving rules, and let Groundswell handle the rest.

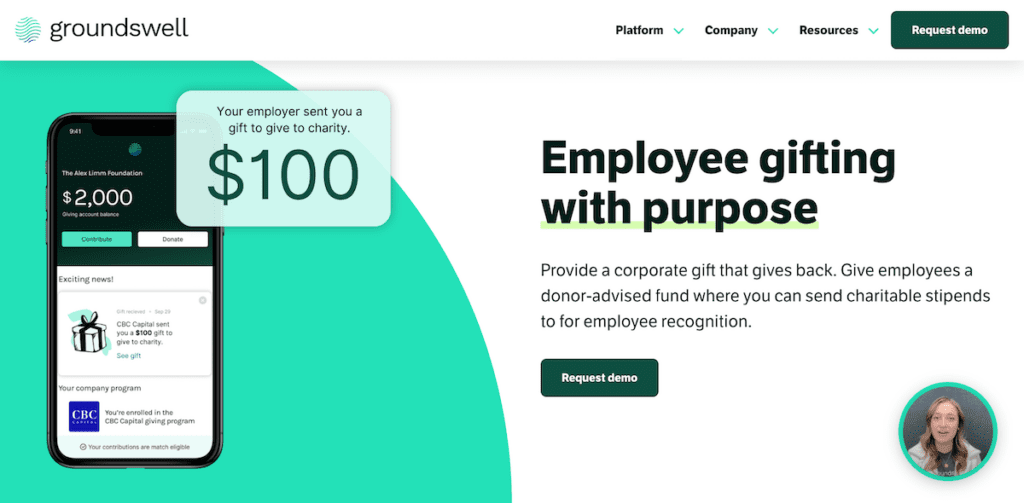

Matching and Gifting Made Simple

The platform automates fund matching, ensuring that your employees’ contributions are multiplied in their Personal Giving Accounts.

Additionally, you can send charitable stipends to employees’ giving accounts during significant milestones, such as work anniversaries or promotions. Groundswell makes it easy to celebrate these moments while fostering a culture of giving.

Unlimited Personal Giving Accounts

Groundswell provides employees with a simple and secure mobile app to save, donate, and track all their giving funds in one place. This user-friendly interface enhances their giving experience and encourages ongoing participation.

Seamless Volunteering Experience

Logging volunteer hours has never been easier with Groundswell’s mobile app. Employees can conveniently track their volunteer activities, making it simpler for you to generate volunteer matches. Encourage and recognize employee volunteerism effortlessly.

Comprehensive Corporate Grants

The platfrom goes beyond employee gifting and matching by enabling you to leverage the platform for all your corporate grant-making initiatives. Streamline your grant process and maximize your impact by utilizing Groundswell’s robust features.

Data-driven Reporting

Stay updated on the status and utilization of your giving program with real-time data reporting. Gain valuable insights into the causes your employees support and measure the effectiveness of your philanthropic efforts.

Interview Transcript

Grant

Well, thank you so much, Jake, for joining me today. I’m really excited to talk about your journey in life, everything you’ve done up to this point, and everything you’re going to do.

But before we get into Groundswell, take us back through your journey. I know you’ve talked about it in your book and a bunch of interviews and speaking engagements, but talk us through your time before Team Rubicon, with the Marines, and then we’ll get into Groundswell and becoming a startup founder.

Jake

Yeah, sure. Well, thanks for having me on. Glad to be here. I definitely have a non-typical journey toward being a software CEO and startup founder. I always wanted to do something entrepreneurial, but I’m not sure I took the straight and narrow path to get there.

I joined the Marine Corps after college in 2005. It was an interesting decision, obviously very consequential since we were at war in both Iraq and Afghanistan. I ended up serving for four years in the Marine Corps, mostly overseas.

My first tour was in Iraq as part of an infantry rifle squad running counterinsurgency operations. Later, I joined a Scout Sniper unit and served in Afghanistan as part of a six-man Scout Sniper team. Looking back, I often tell people that’s where I learned how to be an entrepreneur.

Running and building a company involves overcoming challenges, navigating uncertainty and ambiguity, and doing more with less when facing limited resources and information. I didn’t learn how to read financial statements or pitch a venture capitalist, but I learned how to overcome all those other things.

I got out of the Marine Corps in late 2009 and thought my time doing crazy stuff was over. I figured I’d go back to graduate school, get my MBA. The economy was in the tank after the Great Recession, so job prospects weren’t great.

I got accepted to graduate school at UCLA, but before the school year started, I was watching the news and saw the Haiti earthquake. Having just gotten out of the Marines and back from a couple of hard tours, I felt compelled to help beyond just texting $10 to the Red Cross like everyone else.

I ended up working with a couple of other veterans and some doctors, and we organized a team and went down to Port-au-Prince right after the earthquake. We started working, and in doing that, we realized our military experience made us adept at navigating the chaos of that post-disaster situation.

We came back from Haiti after a couple of weeks and decided to form a nonprofit organization, Team Rubicon, with the premise that we could build a best-in-class disaster response organization by recruiting military veterans to repurpose their skills for humanitarian work.

It’s been 13 years now, and the organization has scaled from those original eight volunteers to a global organization with over 160,000 volunteers and a $75 million annual budget. It’s been a journey full of ups and downs, but the organization is doing incredibly well.

I would put us up against any organization in terms of the efficacy of our programs and the impact we’re driving in communities across the country and around the world.

Grant

It’s impressive. I knew Team Rubicon for years and remember watching the work and reading about what they did. I went to Haiti after the earthquake, and I remember reading about Team Rubicon being there. It’s incredibly difficult work, seeing such destruction and loss of life.

It’s overwhelming and emotionally draining, also physically. Friends who dealt with Hurricane Katrina experienced similar things. The destruction is jaw-dropping, but trying to save lives amidst it is transformational.

After such experiences, sticking with building a nonprofit mindset for a decade, what did you learn? How did you transition to the nonprofit world? What were some positives and areas for improvement from your work there?

Jake

One of the biggest lessons is the fallacy that the nonprofit space is fundamentally different from the corporate space. At Team Rubicon, we tried to run it like any startup. We had to be ruthlessly efficient, grow responsibly, manage budgets, execute programs, and deliver a world-class product.

Our product was helping people after disasters. We had to build it, market it, sell it to donors, and deliver it consistently and professionally. If you’re not taking it as a serious business enterprise, you have no business running a nonprofit.

I wouldn’t invest my charitable dollars with you if you saw it as a mom-and-pop feel-good thing. You need to approach it like you’re building a world-class Fortune 500 company.

We paid attention to building a strong brand, attracting corporate sponsorships, and utilizing effective storytelling to build a grassroots movement of volunteers and donors. Measuring and reporting outcomes is crucial.

Donors invest their hard-earned money because they want to create change. If you’re not measuring, holding yourself accountable, and reporting impact back to the donor, you’re doing a disservice to both the donor and the communities you’re supposed to serve.

We were ruthless in holding ourselves accountable to outcomes. We didn’t always get it right, but it was a journey to understand our impact and identify what we were missing. It’s an ever-evolving journey. If you think you’re there, you’ve already lost.

Grant

I’ve talked to several founders who transitioned from nonprofits to for-profit companies. Running a nonprofit is a great internship for becoming a for-profit startup founder because of the hard things you have to do to start and sustain a nonprofit. It’s not a product; it’s an outcome.

Fundraising, building a team, and being efficient are all skills that translate to starting a for-profit company. Everyone I’ve talked to who transitioned from nonprofits has built strong startups.

When you mentioned passing on an MBA to start a nonprofit, I thought the nonprofit route might have been better for your ability to learn.

Jake

Yeah, I don’t doubt that at all. I know what you’re saying, but calling it an internship is a disservice.

Grant

I was trying to find another word. It’s a great place to start, going through growing pains in a different but similar way to a company.

Jake

I would argue it’s more challenging than operating on the for-profit side, especially in an industry that can attract venture investment. You can’t get a bank to loan you money, and it’s hard to find venture capitalists willing to write big checks.

When I made the leap from Team Rubicon to Groundswell, one of my early investors, Heather Hartnett from Human Ventures, who has a nonprofit background and is now a VC, said, “You realize you were training with ankle weights on when running a nonprofit.”

It’s like training with ankle weights and then running without them. Running a nonprofit is harder in almost every respect than running a for-profit.

Grant

I’ll ask my next investor if a successful nonprofit founder would be a good criterion for investing in a startup founder. It’s an impressive feat to run a nonprofit successfully. Let’s talk about Groundswell.

I love the idea and think it’s a growing segment. Talk about the idea for Groundswell. When did you know you wanted to transition from Team Rubicon to Groundswell, and what was it like making that decision?

Jake

I knew it was time to move on as CEO of Team Rubicon. I ran it for 11 and a half years. Organizations have to evolve, and part of that evolution is the leadership. I knew I wanted to be an entrepreneur again, but I didn’t know what it would be. We had a strong succession plan in place as we came into 2021.

As I watched my family grow and the organization thrive during COVID, I knew the timing was right. I tapped my longtime friend and colleague, Art delaCruz, our COO, and said, “It’s your turn.” He’s done a great job leading the organization for the last two years. Once I made that decision, I started coming up with ideas.

One idea kept coming back to me, which became Groundswell. Running Team Rubicon for over a decade, I learned a lot about philanthropy and saw its inefficiencies. The idea of democratizing philanthropy, giving everyone the tools to make their giving as effective and impactful as the ultra-rich, was inspiring. Groundswell is the world’s most modern donor-advised fund.

We’re selling the platform to companies, making philanthropy an employee benefit, and decentralizing corporate giving decisions. Employees can support what matters most to them.

We’ve been at it for a couple of years, and the product has been live for a year with remarkable results from early customers. We think we’re onto something.

Grant

Did you know about donor-advised funds through Team Rubicon? Was Groundswell always going to be based on the donor-advised funds model, or did that come later?

Jake

It was always focused on donor-advised funds. I was frustrated that I didn’t have one. It blew my mind that in 2021, with all the advances in fintech, nobody had disrupted DAFs. You still had to go to old brokerages or wealth management firms and fork over $10,000 or $20,000 to open one.

I thought, “This is ridiculous.” I can Venmo my lawn guy with a smiley face emoji, but if I want to open a donor-advised fund, I have to go to Vanguard or Fidelity, which is like a technological root canal.

Grant

When starting out, there’s a beautiful moment full of invigoration and energy. But then you have to raise money. What was that process like, and what was the first year like as a for-profit entrepreneur versus a nonprofit?

Jake

I was lucky. Through my experience running Team Rubicon, I developed relationships with great business leaders. When I made the decision and put together the plan for Groundswell, it only took a couple of phone calls to raise the first couple of million bucks.

I realize how fortunate I am. Not many people can do that. It reflects the way I comported myself over the previous decade. I was a serious entrepreneur who built a serious nonprofit organization and invested in those relationships.

They saw me grow as an entrepreneur, knew I could lead, build a team, and hold myself and my team accountable to outcomes. When you’re an investor writing early-stage checks, you’re investing in the person. De-risking that decision by knowing the person is key.

I was lucky to raise a substantial round from friends and family, including CEOs and some venture investors. When we went to raise our formal round in late 2021, it got more intense. Now you’re on calls with senior partners from iconic venture firms in Silicon Valley.

The heart rate gets going, but we were able to raise money pre-product, which you can’t do today. We got lucky with timing, but we capitalized on it. We pitched 8 to 10 top VC firms, got term sheets from three, and went with GV (Google Ventures). We’re lucky to have them on board for the journey.

Grant

The idea is that companies offer this as an employee benefit. Employees can donate to any nonprofit, and the company matches it, similar to a 401k but for philanthropy. Is that an elementary way of looking at it?

Jake

Yes, thinking of it like an HSA or a 401k for charity is appropriate. It’s a tax-advantaged giving account. Each employee gets their own donor-advised fund.

They can contribute through payroll deduction, stock, or company matches. Employees control the money, can send it to any charity whenever they want, and can take it with them if they leave the company, just like a 401k.

We’re rethinking employee giving, making it more efficient and impactful.

Grant

When building the platform, you have a powerful idea that can scale across any size company. How do you decide to add new features as the platform grows? You now have things like votes, volunteering, corporate grants, and employee experiences. How do you assess adding new features?

Jake

We have a list of features we want to build, and it’s long. We have many ideas on our product roadmap that are innovative and exciting. Ultimately, we’re listening to customers. We know there are some features our platform lacks that legacy competitors have. Some of those we don’t intend to build because they lack impact and utilization.

Others we know we need to build, and it’s a matter of time. It’s a balance of prioritizing feature parity decisions against net new, highly differentiating features. We’re diligent about analyzing why we lose deals and listening to customers.

It’s a world full of trade-offs. Everything we say yes to means saying no to something else. As a CEO, I want to say yes to more, but we’re constrained by our team’s limitations.

The business model is an annual fee for the business based on the number of eligible employees. It’s an enterprise business model. We charge our customers annual fees and have additional monetization levers. It’s mostly enterprise SAAS revenue.

Grant

The last question is about the future. Coming out of Team Rubicon and building it up, spending over a decade of your life in it, it’s a great accomplishment to build something successful and leave it thriving.

Now, looking at Groundswell, which will likely be the next decade of your life, what does the next three to five years look like? What are some of the goals and successes you and the team would like to achieve?

Jake

It’s hard to think in terms of decades when you’re focused on the next 10 months. It’s a tough economic environment, and nothing is certain. We’re laser-focused on the next year, hitting targets to raise our next round of financing. But zooming out, we’re a mission-driven company.

We’re trying to create lasting change and a paradigm shift in corporate philanthropy. We want donor-advised funds to be as ubiquitous in the future as 401ks are today.

The 401k was introduced in 1980 and quickly became common. We want tax-advantaged giving accounts to be offered to employees at any wage level. 73% of American households give to charity every year. How can we help them do that more efficiently? That’s the future we want to see.

Grant

Thanks so much, Jake, for taking the time. I know you’re busy building a lot of stuff. I appreciate you taking time out of your day to talk about what you’re working on, what you’re building, and what you’re disrupting. It’s incredible what you’ve done so far, and best of luck for the next decade to come.

Jake

Thank you for letting me come on and share the story. We love telling the story of Groundswell and Team Rubicon. Anytime, anywhere.