In Episode 61 of the Investing in Impact podcast, Causeartist contributor, Rafael Aldon, speaks with Arman Anatürk, the Co-Founder and CEO of HackCapital, on building the infrastructure platform for sustainable finance.

Listen on Spotify – Listen on Apple Podcast – Learn more about the podcast here.

Arman Anatürk is the Co-Founder and CEO of HackCapital, an investment platform that aims to unlock billions in new capital towards private companies working on impact solutions. He is also a founding member of FoodHack, the world’s largest foodtech community.

Arman is passionate about using technology to solve some of the world’s biggest challenges, such as climate change and food security. He believes that HackCapital can play a key role in mobilizing capital towards these important areas.

About HackCapital

HackCapital is a platform that provides purpose-built fundraising and liquidity tools for impact funds and startups. The platform offers a variety of features, including:

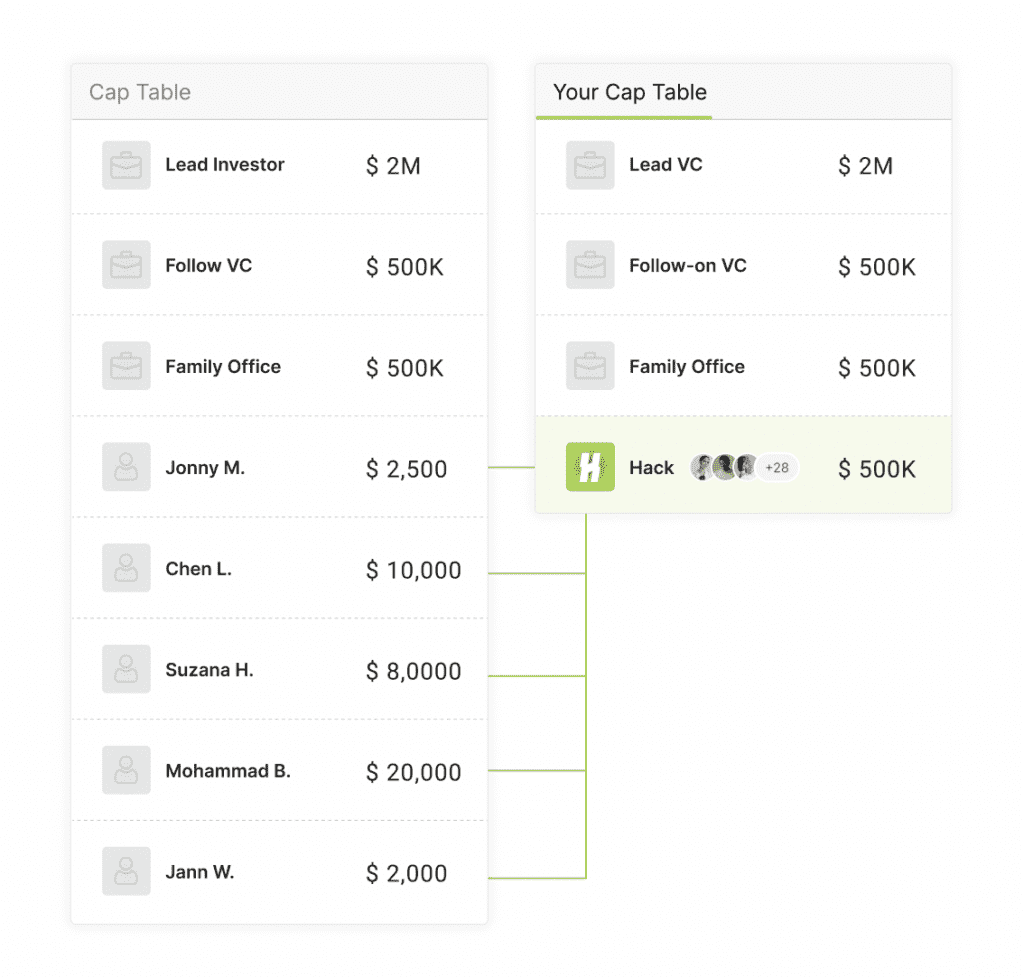

- Roll-up vehicles: This feature allows startups and syndicates to roll up multiple investors as a single line on their cap table. This can make it easier for startups to raise capital and for investors to track their investments.

- Feeder funds: This feature allows fund managers to roll up multiple investors as a single LP into their fund. This can help fund managers to raise capital more quickly and efficiently.

- Micro vehicles: This feature is designed for emerging managers who are looking for an alternative option to quickly set up and raise an investment vehicle.

- Custom structures: HackCapital can also help investors to structure investments into target assets. This can be helpful for investors who are looking to invest in specific impact sectors or regions.

In addition to these features, HackCapital also offers a number of benefits, including:

- New investor base: HackCapital can help investors to access a new pool of investors who are interested in impact investing.

- Increased liquidity: The platform is designed to accommodate secondaries, which can help investors to sell their investments more easily.

- Fully digitized: The platform is fully digitized, which can save time and money for investors and fund managers.

- 24-hour setup speed: The platform can be set up in a matter of hours, not weeks.

- Neutrality: The platform is neutral, which means that it does not compete with its investors or investees.

- EU based: HackCapital is based in Switzerland and Luxembourg, which gives it a strong legal and regulatory framework.

HackCapital is a valuable tool for impact investors and fund managers who are looking to raise capital and manage their investments more effectively.

The platform’s features and benefits can help investors to access a new pool of investors, increase liquidity, save time and money, and achieve their impact goals.