Welcome to Episode 87 of the Investing in Impact podcast. Today, I’m joined by Dr. Andy Kuper, Founder and CEO of LeapFrog Investments, a pioneering firm that has reshaped how global capital can drive profit with purpose.

Since launching the firm in 2007, Kuper has led with a bold vision: to deliver "Profit with Purpose" by investing in businesses that generate strong returns while solving real-world challenges across Asia and Africa.

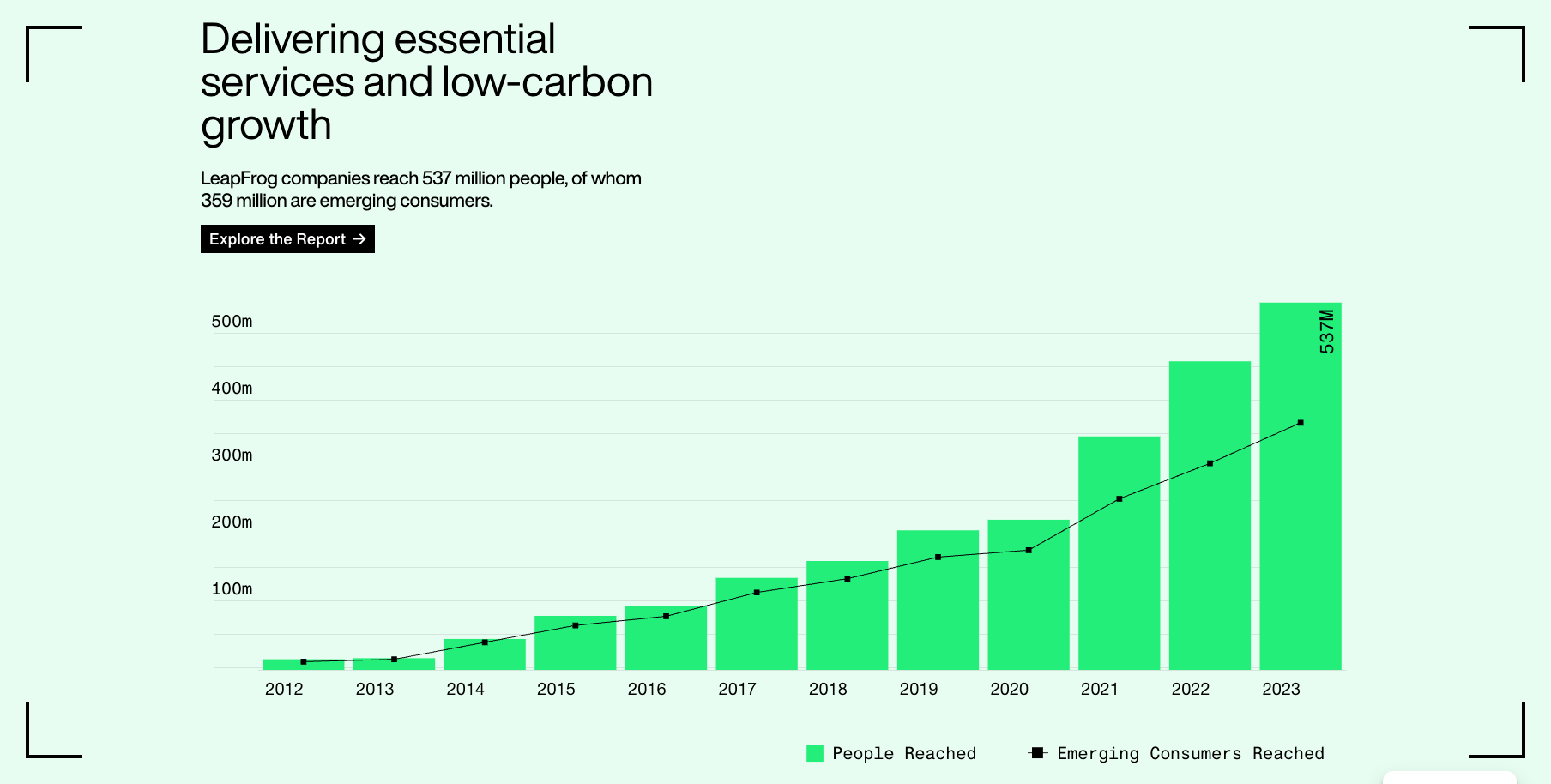

📈 Impact at Scale: 537 Million Lives Reached

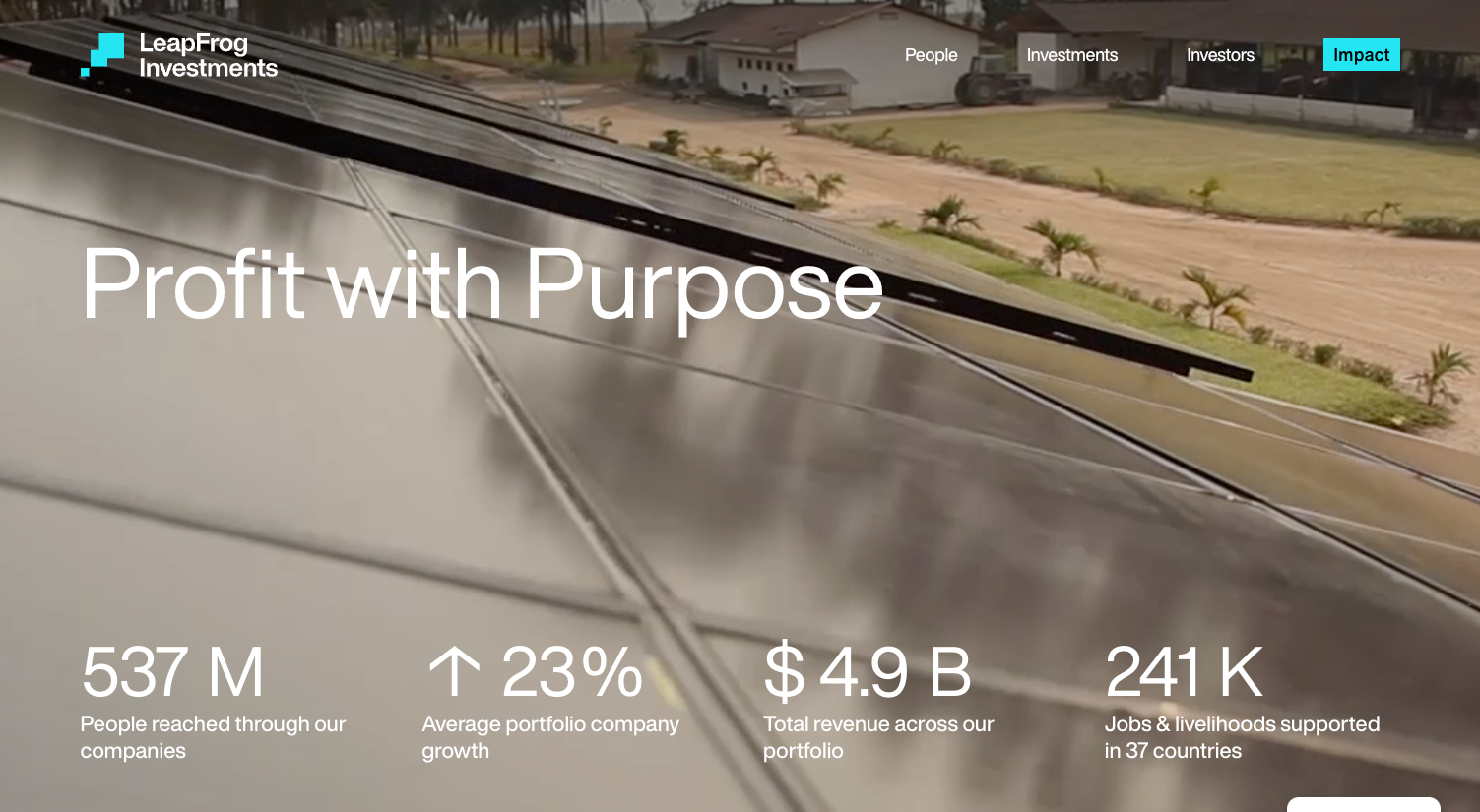

Today, LeapFrog’s portfolio companies serve over 537 million people, providing access to essential services like healthcare, financial tools, and climate solutions.

Of those reached, 359 million are emerging consumers, many of whom are gaining access to formal financial and health services for the first time.

Beyond reach, LeapFrog’s investments have supported over 241,000 jobs and livelihoods in more than 37 countries, contributing to inclusive economic development at scale.

💸 Billions Raised, Sustainable Growth Delivered

LeapFrog has secured nearly $3 billion in capital commitments from some of the world’s leading financial institutions.

The firm typically invests $20–75 million in high-growth companies led by exceptional teams, targeting influential minority or majority stakes.

These portfolio companies have achieved an average annual growth rate of 23% since investment—proving that social impact and financial success are not mutually exclusive.

🏆 Global Recognition for Global Impact

LeapFrog has received international acclaim for its transformative approach. Fortune named it one of the Top 5 Companies to Change the World, alongside Apple and Novartis—making it the first private investment firm to earn that recognition.

Dr. Kuper has been honored worldwide, including being appointed an Officer of the Order of Australia in 2022 for distinguished service to impact investing and financial inclusion.

🎓 Scholar, Author, and Advocate

Originally from South Africa and now an Australian citizen, Andy Kuper holds a Ph.D. from the University of Cambridge and has held academic roles at Harvard, Cambridge, and Columbia.

He’s the author of two books on globalization and governance and has co-authored publications with Nobel laureates and international leaders.

📊 Leading the Way in Impact Measurement

LeapFrog is not only a pioneer in impact investing but also a leader in measuring and reporting impact. The firm is a signatory to the UN Principles for Responsible Investment, earning their highest A+ rating.

It also plays a leading role in advancing industry standards as a founding Investors Council Member of the GIIN and a contributor to the Impact Management Project.

🚀 Aiming to Impact One Billion Lives

With a mission to reach one billion people through the power of capital markets, LeapFrog Investments continues to raise the bar for what’s possible in private equity and impact investing.

By combining rigorous financial discipline with a deep commitment to social good, LeapFrog proves that capital can be a catalyst for lasting, systemic change—especially in the places that need it most.

Episode Transcript

Grant:

Andy, thank you so much for joining me today. I've been following LeapFrog for a long time—not since 2007, but definitely since the early 2010s. Back then, “impact investing” wasn’t a common phrase. It wasn’t top of mind like it is today. You and the LeapFrog team really helped push that term forward. You've been putting capital markets into impact in a way that’s inspiring. It’s a good time now to be an entrepreneur in parts of the world where that wasn’t always the case.

You and the team just raised a fund over $1 billion, which is incredible. But I want to go back to the beginning. What was written on that napkin in 2007 that started it all?

Andy Kuper:

Great to be here, Grant. When I incorporated LeapFrog in January 2007, the term “impact investing” didn’t even exist. People looked at me like I had two heads when I said you could have “profit with purpose.” At the time, it seemed like you had to choose between ruthless capitalism or the Mother Teresa path. But I believed that was a false choice.

There are amazing businesses that truly transform lives, and they deserve to be backed at scale. Our mission became: open the gates of the capital markets to purpose-driven businesses.

What really sparked the idea was watching Steve Jobs unveil the iPhone in early 2007. I realized that billions of people would soon be connected to the global economy through mobile technology. That digital infrastructure created a massive opportunity to reach and serve underserved consumers—especially through financial services. Philanthropy plays a role, but it’s small compared to capital markets. I wanted to tap into that larger pool of capital to scale businesses that could reach billions.

Grant:

Before LeapFrog, what did your journey look like? What shaped your thinking?

Andy Kuper:

I grew up in apartheid South Africa. My parents sent me to the only unsegregated school at the time. I experienced firsthand how systems can be deeply flawed. I was there when Nelson Mandela became president—it was life-changing. That moment showed me that a small, committed group can transform society.

Later, I worked with Muhammad Yunus, the Nobel Prize-winning pioneer of microfinance, and with Fazle Abed of BRAC. These mentors helped lift entire nations through innovation. I also worked in India and experienced both success and failure—lessons that shaped my view of business and scale.

At Ashoka, where I was managing director, I saw incredible social entrepreneurs. But the missing piece was capital—commercial capital. That’s what LeapFrog set out to provide.

Grant:

Do you remember those first pitches? What convinced the early believers?

Andy Kuper:

Absolutely. At first, we faced 95 rejections for every one “maybe.” But I think we touched something deeply human. Most people don’t want to choose between profit and purpose—they want both. We built LeapFrog around that idea.

The early believers like Pierre Omidyar (eBay), Calvert, and Accion took the leap with us. President Clinton helped us launch LeapFrog right after the collapse of Lehman Brothers—which sounds crazy, but it bonded us as a team. Nine months later, we closed our first $42 million.

Grant:

Now, “impact investing” gets used a lot. But how do you personally define it?

Andy Kuper:

At its core, impact investing means putting money behind companies and funds that deliver measurable positive outcomes—either for society or the planet.

Those outcomes vary: it might be job creation, access to healthcare, climate solutions, or financial services. What matters is intention. You define your impact goals at the start and follow them through to the end, including a responsible exit.

We helped build industry standards like the IRIS metrics and the Operating Principles for Impact Management. LeapFrog is one of just 12 global firms with a perfect score across those principles. It’s about embedding impact and measurement into the full investment lifecycle.

Grant:

What are some standout companies in LeapFrog’s portfolio?

Andy Kuper:

I’ll give you three—one each in climate, healthcare, and financial services.

1. Climate: Battery Smart (India)

They provide battery-as-a-service for electric two- and three-wheel vehicles. Instead of waiting to refill with gas, drivers swap batteries in under a minute—cheaper, faster, and cleaner. It’s a win-win and supports gig workers. With 1.4 billion people, India is going electric fast—and this business is at the center of that shift.

2. Healthcare: Goodlife Pharmacies (Kenya)

We took over a small chain of 19 pharmacies and scaled it to over 150 health hubs. The government reported that 30% of medications in Kenya were fake or misprescribed. We changed that by building a clean supply chain, training staff, and even introducing telemedicine. Now, millions of Kenyans have access to trusted healthcare—often better than what’s available in developed countries.

3. Financial Services: Mahindra Insurance Brokers (India)

We partnered with the Mahindra Group to digitize and scale their insurance offerings. One product, inspired by our work in Ghana, offers family health insurance for as little as $0.70/month. That product alone now reaches over 2 million people. When you serve millions at even $2/month, you’re creating serious revenue—and impact.

Grant:

These are foundational shifts. They require not just capital, but the right kind of capital—and a patient approach. What other support do you give portfolio companies?

Andy Kuper:

We offer far more than capital. We bring:

- Data Analytics: With over 500 million lives reached, we have powerful insights on what works.

- Customer Experience (CX): We track the customer journey to improve outcomes.

- Talent Accelerator: We help companies build top teams.

- Impact Team: We guide metrics and ensure intention is met.

This holistic support makes our companies better managed and more profitable—while delivering impact.

Grant:

So now you've raised over a billion dollars. The latest fund includes names like Temasek, Prudential, EIB, DFC, Ford Foundation, IKEA Foundation. What's next?

Andy Kuper:

We’re proud of the latest fund and our incredible partners. Temasek and Prudential have each committed over $500 million to LeapFrog. Others like AIA, EIB, and IFC are longtime backers.

But our mission is bigger than any one fund.

By the end of the decade, we aim to reach 1 billion low-income people with essential services. And through that, we want to inspire other institutions to reach all 4–5 billion emerging consumers.

We’ve also helped build the impact investing infrastructure: standards, metrics, independent audits. We want this industry to grow from $1.5 trillion to $10, $20, even $26 trillion—as projected by the IFC.

And we believe that when capitalism works for everyone, the entire system improves. This isn’t about hugging trees. This is a smarter, more inclusive form of capitalism.

Grant:

That’s incredible. Andy, thank you so much for your time and for sharing your journey. You and the LeapFrog team have walked the talk for nearly two decades—and I’m excited to see where the next decade takes you.

Andy Kuper:

Thanks, Grant. We’ve just turned 18, so we’re officially an adult now. The teenage years were good—but the best is yet to come.