Let me start off by stating that I am not a financial advisor by any means and I only mention these platforms below, because they are interesting to me personally and I thought I would share them. I personally always look for different ways to invest in social impact ventures in a socially responsible way. In my research these are the platforms that I found to be doing some really interesting things in the space of investing in social impact ventures.

If you are interested in learning more about social impact investing check out the GIIN’s 2017 Annual Impact Investor Survey. The report is based on an analysis of the activities of 209 of the world’s leading impact investing organizations, including fund managers, foundations, banks, and development finance institutions. The respondents in this report collectively manage nearly USD 114 billion in impact assets, a figure which serves as the best-available “floor” for the size of the impact investing market.

Swell

Pacific Life’s incubator startup, Swell, has officially launched! The new social impact investing platform provides consumers the opportunity in invest in various conscious investment projects focused on six positive future categories: Green Technology, Renewable Energy, Zero Waste, Clean Water, Healthy Living and Disease Eradication. Swell requires a $50 minimum investment and charges a $0.75 annual fee to optimize your portfolio throughout the year. If you invest $500, Swell will cost you $3.75 per year.

WeFunder

Wefunder is a crowd investing platform for social impact ventures. They help seed investors purchase stock for as little as $100 in the most promising new businesses around the country, including PBC B-Corps. When you arrive at the WeFunder website click explore link in the top left of the homepage. In the explore area you will be presented with categories of startups you can invest in. Choose the PBC and B-Corps option they have available. You can also choose from a drop down option labeled social impact, so let’s helpful as well.

OpenInvest

OpenInvest is the world’s first automated Socially Responsible Investing tool. The platform uses sophisticated technology to create comprehensive financial portfolios for individual thoughtful investors who want their portfolios tailored to both their finances and personal values. The platform allows you to easily invest in companies that support LGBTQ rights, Climate Change, Women’s Rights, and other incredibly important causes. OpenInvest makes it easy to know which companies are behaving the way you want them to, and which companies aren’t.

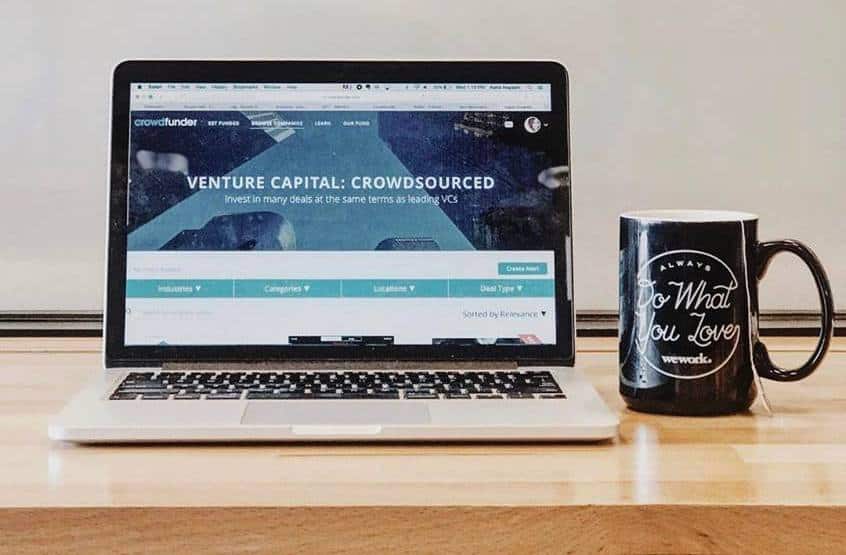

Crowdfunder

Crowdfunder is another equity crowdfunding platform for sourcing and funding high-growth social impact ventures with a network of over 130,000 entrepreneurs and investors. Crowdfunder and its VC Index Fund provide the opportunity for direct online investment into single ventures, as well as diversification into a broad VC-led portfolio (Index Fund) of early-stage startups – backed by many of the world’s leading Venture Capital firms and private investors.

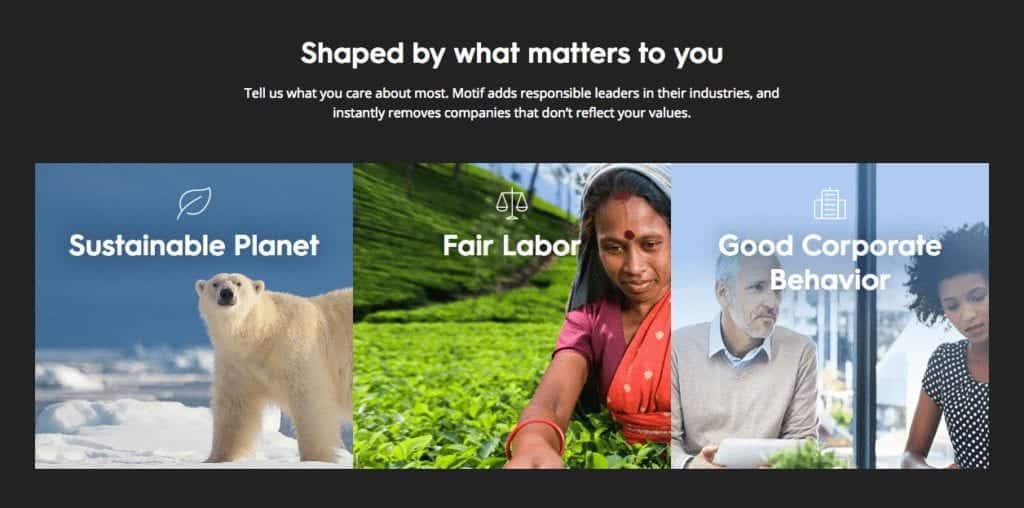

Motif

Motif Investing is a thematic investing platform that allows you to act on your investing desires—whether a hot trend like Sustainable Planet, Clean Tech, Fair Trade or an investing style like an Ivy League Endowment model. When going to their rollover the What We Offer link and choose Impact Portfolio.

Enable Impact

Enable Impact offers accredited investors access to private syndicates and curated deals, and helps social entrepreneurs raise capital in a more targeted and efficient way. Enable is a conduit and catalyst to activate incremental capital into the impact sector helping to grow businesses that have a social purpose and mission in a more efficient and effective way. You can source direct impact investments, vetted by Enable Impacts investment committee and delivered to your inbox. The platform is set up to back entrepreneurs that are solving critical issues in a sustainable way.

Social Stock Exchange

Through a unique partnership with regulated investment exchange ISDX, the Social Stock Exchange is the only venue of its kind in the world to give impact businesses of all sizes the opportunity to access public financial markets. From seed investment through to IPO and secondary listings, the Social Stock Exchange is able to cater for all fundraising and visibility needs of those companies that fit its admission criteria. The Social Stock Exchange robust impact validation process and impact reporting framework will give investors and companies alike the confidence that both financial and impact outcomes are equally accounted for and valued in the investment process.

WealthSimple

Wealthsimple is investing on autopilot. They will build you a personal, low-cost portfolio and put your money to work like the world’s smartest investors. The company also offers SRI(socially responsible investing) featuring its socially responsible ETFs for your portfolio. The SRI portfolio has the same great features all Wealthsimple portfolios do. Now you can feel good about your investments morally as well as financially.