In a move to fuse financial technology with environmental stewardship, Karma Wallet recently announced the launch of their Karma Wallet Card, a new spending tool that redefines the power of purchase.

Backed by $2M+ funding injection from socially conscious investors, including the innovative Tweener Fund, this could launch a new era of impact-driven, conscious consumerism.

A Disruptive Force in FinTech

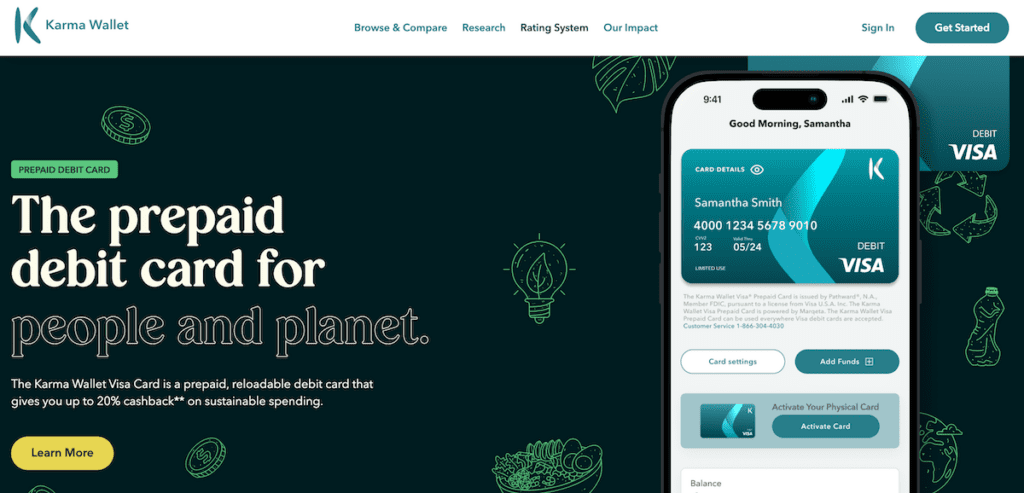

The Karma Wallet reloadable prepaid debit card is the first financial product to provide real-time insights into the social and environmental impact of every transaction.

The brand’s growing community now has the ability to turn their daily and recurring expenses into direct action, earn cashback rewards, and automatically support reforestation efforts and local food security initiatives on select purchases.

“There is a big gap between intention and action,” said Karma Wallet CEO and co-founder Jayant Khadilkar. “Through the Karma Wallet Card, we’re turning everyday transactions into opportunities for profound action.”

Turning Everyday Transactions into Opportunities for Action

The Karma Wallet companion app comes with a dashboard that provides an unparalleled view into the socioeconomic impact of each purchase, and access to comprehensive impact evaluations of 15,000+ brands.

This proprietary ecosystem showcases where, and more importantly how, cardholders can make purchasing decisions that reflect their individual ethos, and the card allows members to put that directly into action.

“Our members are change-makers; participating in a global effort to use money as a tool for change,” explains Kedar Karkare, PhD, Karma Wallet’s co-founder. “Our mission is to enlighten, engage, and empower consumers to be the change they want to see in the world, one purchase at a time.”

Poised to Catalyze Mindful Spending

With the $2M+ capital poised to propel the company into the marketplace, the team’s vision is clear: to catalyze a shift towards mindful spending, educate consumers, and shape a future where every dollar spent supports a more sustainable and equitable world.

Karma Wallet Ratings System

Karma Wallet gathers data from over 30 trusted sources to evaluate companies on their social and environmental impact.

This data is mapped to the UN Sustainable Development Goals (SDGs) which are grouped into People and Planet categories with subcategories of Sustainability, Climate Action, Community Welfare, and Diversity & Inclusion.

Each company is rated on a scale of -16 to 16 based on their performance across 16 relevant UN SDGs. For each SDG, they can earn a score of passed, partial, neutral, failed, or no data. The sum of these scores determines their overall rating.

It also identifies specific values for companies like climate neutral certification, cruelty-free status, or water stewardship. This gives a more complete picture of a company’s sustainability efforts.

The company ratings are compared to sector averages to benchmark performance. Karma Wallet ensures credibility by checking company data against third party sources to avoid greenwashing and provide consumers the truth about social and environmental impact.

Karma Wallet Story

Karma Wallet was founded by Kedar Karkare and his father Jayant after Kedar struggled to find ways to be a conscious consumer without proper tools to measure and verify the impact of his purchases.

With Kedar’s background in data science, they created a platform aimed at evaluating companies for their social and environmental impact so consumers can shop intentionally.

Karma Wallet focuses on creating a fair, transparent system for this evaluation.

They rely solely on trusted third-party data sources or require direct proof of impact from companies. The scoring system uses a simple, transparent formula that could be replicated.

Karma Wallet never accepts payment to adjust scores to maintain honesty. The goal is to give consumers the knowledge to align purchases with their values through access to credible impact data.

Through Karma Wallet, consumers gain personalized data around their carbon footprint, insights into their shopping habits, cashback, and sustainable rewards.