In episode 191 of the Disruptors for GOOD podcast, I speak with Niles Lichtenstein, founder of Nestment, on making real estate investing and ownership more accessible.

Listen on Spotify.

Listen on Apple Podcasts.

Listen to more Causeartist podcasts.

Real estate has long been considered one of the most lucrative investment options, but it has often been out of reach for many due to high capital requirements and complex processes.

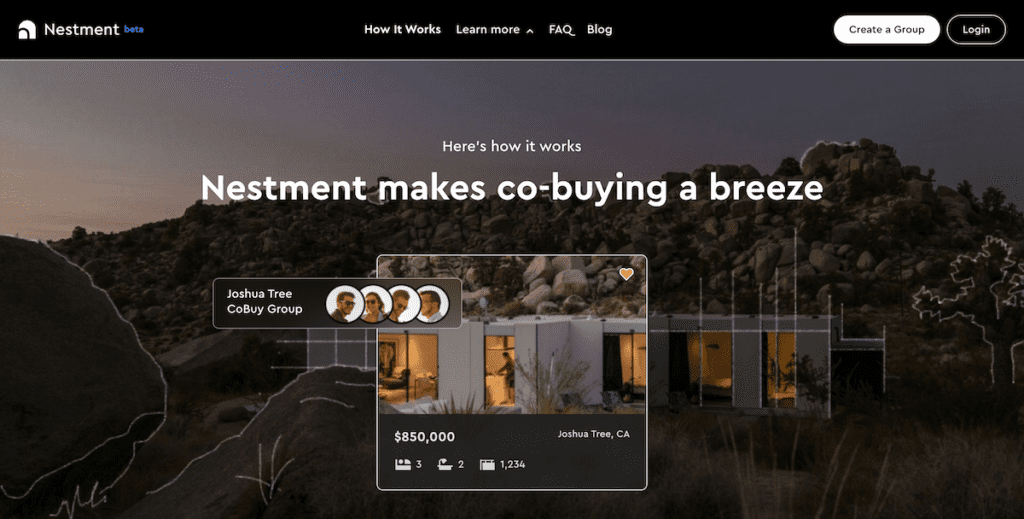

However, Nestment, a disruptive startup, is changing the game by leveraging technology to revolutionize real estate investment through co-investing and co-ownership.

Streamlining Real Estate Investment

Nestment is a platform that aims to simplify the real estate investment process, making it accessible to a broader range of investors. The platform offers a user-friendly interface where investors can browse through a curated selection of high-quality properties.

Their team of experts carefully analyzes and selects properties based on factors such as location, potential returns, and market trends, ensuring that investors have access to lucrative investment opportunities.

One of the key features that sets the company apart is its co-investing model. Instead of requiring investors to fund an entire property purchase on their own, Nestment allows them to pool their resources with other like-minded investors.

This co-investing approach significantly lowers the entry barriers for individuals who may not have substantial capital to invest.

By sharing the investment with others, investors can gain exposure to a diversified portfolio of properties and reduce their risk.

How Does Nestment Work?

Step 1: Create Your Group and Explore Cities With Nestment

Users can easily create investment groups and invite friends to join. Together, you can embark on an exciting exploration of cities, uncovering lucrative real estate opportunities. Discover diverse neighborhoods, evaluate market conditions, and identify properties that align with your investment goals.

Step 2: Search, Share, and Save Listings

Nestment’s intuitive platform allows group members to search, share, and save listings effortlessly. With a comprehensive database at your fingertips, you can efficiently evaluate properties, compare features, and collaborate with your group to make informed investment decisions.

Step 3: Utilize the Nestimate Calculator for Financial Insight

Maximize your investment potential by leveraging Nestment’s Nestimate calculator. With this powerful tool, you can instantly determine if a listing aligns with your financial goals. Gain valuable insights into projected returns, assess potential risks, and make well-informed investment choices.

Step 4: Introduction to Your Nestment Relationship Manager

Upon joining Nestment, you will be introduced to a dedicated relationship manager who will guide you through the co-buying process. This experienced professional will work closely with your group to understand your investment objectives, assist with essential paperwork, and ensure your investment journey remains organized and streamlined.

Step 5: Prepare to Bid with Confidence

Your Nestment relationship manager will assist in preparing your group’s legal structure, ensuring compliance with regulations and establishing a solid foundation for your investment endeavor. Additionally, they will help you navigate the pre-approval process with lenders, ensuring you are well-positioned to submit competitive bids.

Step 6: Bid on Homes with Support from Top Realtors

Through Nestment, you will be matched with top-performing realtors who possess extensive market knowledge and expertise. Leveraging their guidance and insights, you can confidently place bids on properties when the right opportunities arise, increasing your chances of securing profitable investments.

Step 7: Closing Process with Nestment’s Support

As you approach the closing stage, your Nestment relationship manager will continue to provide invaluable support. They will guide your group through the intricacies of the closing process, ensuring a smooth and successful transaction.

Co-Ownership for Increased Accessibility

In addition to co-investing, Nestment embraces the concept of co-ownership, further democratizing real estate investment. Co-ownership allows investors to own a fraction or share of a property, rather than needing to purchase the entire property outright.

This opens up the possibility of investing in premium properties that would otherwise be unattainable for individual investors.

Nestment Co-Ownership Advantages

First – The platform provides investors with flexibility and the ability to diversify their real estate portfolio. Instead of tying up their capital in a single property, investors can spread their investment across multiple properties, reducing the risk associated with concentrated investments.

Second – Co-ownership enables investors to participate in high-value properties, such as commercial spaces or luxury residences, that would typically require substantial capital.

Third – The platform also helps facilitates the process of co-ownership by handling legal and administrative tasks, allowing investors to focus on the potential returns of their investments. Nestment ensures that all fractional owners have clear rights and obligations, creating a transparent and secure environment for investors.

Interview Transcript

00:09

Host: Thank you so much for joining me today. I’m very excited to chat about Nessman and your journey. It’s been incredible so far. Before we get into Nessman and its mission and vision, could you talk a bit about your entrepreneurial journey before Nessman?

00:30

Guest: Definitely. Thank you for having me. I love the podcast and its focus on disrupting and creating social impact. That’s been a theme in my recent ventures. We’ll discuss Nessman shortly, but I grew up in the Bay Area. Many of my startups are connected to personal passions or background. I went to Harvard for undergrad, spent some time on the East Coast, and then returned to California. Nessman started around the pandemic, but even then, we were building companies focused on economic empowerment through different models, especially those disrupted by COVID.

My first startup was in mobile technology, very different from what I do now. That company eventually became part of a larger NASDAQ-listed company. I gained a lot of experience, managing a global team and a larger P&L. Reflecting with a friend, it’s funny to see QR codes everywhere now. Back in 2009, we did the first text call to action in the Wall Street Journal and the first QR code in a magazine. It was groundbreaking at the time.

02:13

Host: It’s funny you mention that. I was talking with my wife about how QR codes were ahead of their time. They didn’t take off for about a decade, then suddenly, they’re everywhere. It’s a testament to persistence.

03:16

Guest: Absolutely. We were fortunate to be part of that innovation. Watching technologies like QR codes evolve and finally catch on is rewarding. It’s similar to how our other ventures focused on positive byproducts from challenging times. For example, we had a company called Inwoven, funded by the New York Times, that allowed groups to tell collective narratives. It started from my desire to know what my late father would say to me before I got married. Collecting content from friends and family, we built rich metadata timelines. This project led to capturing institutional knowledge for organizations, particularly in fashion.

05:00

Guest: I’ve always been interested in small businesses. During COVID, we had to pivot and turn our salon into a hair lab. One entrepreneur was building a robotic haircut mechanism. We also built the Salon Box, a mobile solution for stylists. We noticed gyms shutting down and created Reset Fitness, a system for formerly incarcerated individuals to become master trainers. All these ventures are examples of how we adapt and innovate.

Nessman emerged from conversations about co-owning properties. Reflecting on my own experience, my family managed to keep our home after my father passed by refinancing and renting out rooms. This stability meant a lot. After my first startup, I used my capital to help friends and family buy properties in the expensive Bay Area. Nessman aims to make this process easier by pulling data from Zillow, building spreadsheets, finding lenders, and creating operating agreements. It’s about solving the friction in co-ownership.

13:06

Host: It’s a brilliant idea and a great entrepreneurial example. After initial testing with a landing page and ads, what were the next steps?

14:18

Guest: We focused on three things: desirability, feasibility, and viability. First, we validated desirability through landing pages and ads. Then, we conducted over 200 user interviews to understand feasibility. We built a manual MVP using Google Sheets and forms to test the process. The positive response showed us people were willing to endure a manual process for the outcome. That’s when we decided to build the team and raise capital.

We were intentional about fundraising, partnering with a blockchain fund, prop-tech experts, and investors focused on cooperative economics. We wanted to empower communities of color and immigrants familiar with pooling capital. Our cap table reflects these values.

25:13

Guest: Despite market challenges, our manual MVP had transactions go through. In February 2021, we launched the open beta. We aimed for 100 qualified groups in the first year, using webinars and partnerships to reach our goal. A partnership with BILT, which lets you pay rent and earn points, led to a surge in interest.

We’re now focusing on nurturing leads and perfecting our process. We offer three main models: enabling pre-formed groups, matching partially formed groups, and offering short-term investments. Our ultimate goal is to make more homeowners, not own real estate ourselves.

34:49

Host: Can you explain the business model and future revenue streams?

34:49

Guest: Our main revenue streams come from agent commissions, furnishing homes, and a management dashboard. We take a 40% commission from agents for qualified group leads, earn from furnishing and design services, and charge a monthly fee for the dashboard. Additional revenue comes from insurance and other services.

37:47

Host: Owning a percentage of multiple properties seems like a smart investment strategy.

37:53

Guest: Exactly. For the price of a single home, you could own parts of several homes. It’s about creating opportunities for wealth-building through co-ownership. We provide guidance and ensure people are ready before they invest.

39:27

Host: Education is crucial, especially after the financial crisis. Ensuring people are ready to invest benefits everyone.

39:37

Guest: Absolutely. We prioritize sustainable growth and making informed decisions. It’s better to be a sustainable company helping people build wealth than to chase unsustainable growth.

41:04

Host: What are your goals for the next three to five years?

41:04

Guest: In three years, we hope co-ownership will be a mainstream concept. We want Nessman to be synonymous with co-ownership. In five years, we aim for structural changes in how homeownership is approached. We’re already engaging with Fannie Mae, Freddie Mac, and the CFPB to ensure regulatory alignment. Ultimately, we want Nessman to help families, friends, and communities build generational wealth through innovative ownership models.

44:55

Host: Thank you so much for your time and insights. I look forward to staying in touch.

Guest: Thank you. I appreciate the opportunity and look forward to our continued conversation.