Twelve, an innovative carbon transformation company, has announced a $645 million funding round led by TPG Rise Climate.

This funding is set to propel Twelve's mission of converting captured carbon dioxide into valuable chemicals, fuels, and essential products traditionally derived from fossil fuels.

The financing includes a strategic blend of $400 million in project equity from TPG Rise Climate, $200 million in Series C financing, and an additional $45 million in credit facilities from prominent renewable energy sector funders, marking it as one of the largest rounds in the e-fuels industry to date.

About Twelve

Twelve is a leader in carbon transformation technology, dedicated to eliminating global emissions and forging a fossil-free future.

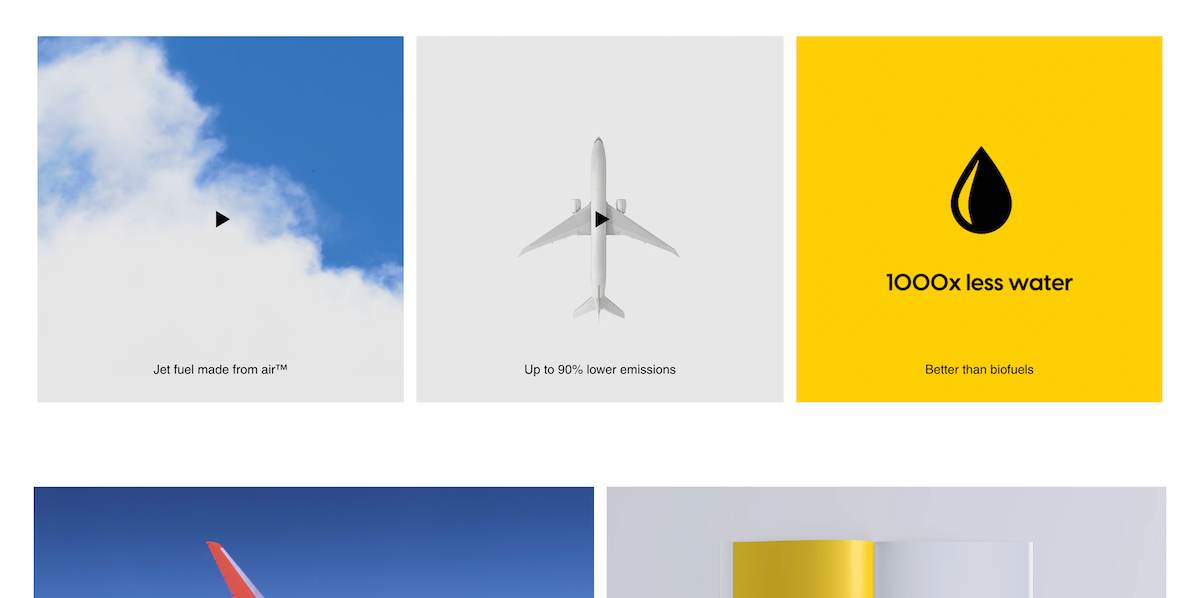

Through their Opus™ Carbon Transformation System, Twelve converts CO2, water, and renewable energy into essential hydrocarbons used in chemicals, materials, and fuels, displacing the need for fossil fuels across industrial and everyday product supply chains.

Transforming Aviation with Sustainable Solutions

"Our financing strategy has been to build a comprehensive capital stack that enables us to deliver product to customers at scale while continually driving down costs," said Nicholas Flanders, Chief Executive Officer at Twelve. "We're proud to work with visionary financing partners and collaborators who share our commitment to deploying first of a kind technologies that address climate change at scale."

The funding accelerates Twelve's efforts to decarbonize manufacturing, initially targeting emissions from aviation. A key milestone for the company is the completion of AirPlant™ One, Twelve's pioneering sustainable aviation fuel (SAF) facility located in Moses Lake, Washington.

Scheduled to commence operations in 2025, AirPlant One will utilize Twelve's patented technology to produce E-Jet® fuel from biogenic CO2, water, and renewable energy sources.

This approach is projected to achieve lifecycle emissions up to 90% lower than conventional fossil jet fuel.

Strategic Partnerships and Market Expansion

TPG Rise Climate's commitment of up to $400 million in project equity underscores their confidence in Twelve's technology and its potential to revolutionize SAF production.

Future AirPlants will supply E-Jet fuel to key customers like Alaska Airlines and International Aviation Group (IAG), parent company of British Airways.

TPG Rise Climate, launched in 2021 as a $7.3 billion climate impact fund, focuses on investments that drive substantial environmental benefits.

Broadening Investment Support

In addition to TPG's significant investment, Twelve raised approximately $200 million in its Series C round, co-led by Capricorn Investment Group and Pulse Fund.

Existing investors, including DCVC, Munich Re Ventures, and Emerson Collective, also participated, highlighting their continued confidence in Twelve's innovative approach.