Let’s face it, no one likes going to the doctor. Many of us put it off until it’s absolutely necessary, and our visit is no longer optional. In fact, our visits to any type of healthcare facility have decreased from just a decade ago.

This is concerning especially for the Latino community as they are the least likely racial group in the United States to seek medical care; yet according to the Centers for Disease Control and Prevention, they are 50% more likely to die from diabetes or liver disease than whites. In fact, 42% of Latinos living in the United States have never visited a medical practice or provider.

The reasons vary, but experts agree this community faces many distinct barriers to accessing health care services including lack of access to preventive care, lack of health insurance and language/cultural barriers.

Actually, research across the board has shown that people of color, particularly Latinos, receive lower-quality health care, suffer worse health outcomes, and have higher rates of certain illnesses.

The cause may be directly correlated to insurance status (Latinos currently make up one in seven Americans, but nearly half the country’s non-elderly uninsured), wealth, as well as income levels. In fact, research has shown that poor Latinos (family income of less than $15,000) have lower access to specialty care than poor non-Latinos.

The lack of health insurance, paired with the high cost of health services, and low wages among the Latino community are some of the most significant barriers impacting the access to help.

The insecurity created by financial, linguistic, or logistical barriers to care means that many Latinos are at risk of not being able to get treatment when required. This places their individual health in jeopardy, and the increased risk of serious illness puts their family’s financial situation even more uncertain.

This is where blockchain technology and affordable money sending & receiving services can play a huge role in deciding whether people get access to these much-needed services. A recent study indicated that international remittances currently hold the greatest impact in reducing the depth and severity of poverty.

Remittances can be used in a variety of ways, but households have started saving a substantial portion of them to be used in unexpected events, such as political turmoil or serious illness. Effectively what remittances are now doing is providing a type of social insurance, a safety net for low-income or undocumented families. Most critically, financial services are not readily accessible to all communities in need.

About Uulala

With a cash deposit system, a blockchain powered platform that allows users to send and receive money, microcredit system, and ATM card all-in-one, Uulala provides a unique solution to a complicated problem. Offering both peer-to-peer as well as peer-to-institution money sending services with a fixed price, Uulala holds the power to revolutionize this particular industry.

The World Bank marks the average transaction fee for sending money is between 7.5%-15%, meaning that not only would Uulala users save money by using this platform, but that those savings could translate to higher investments in health care. Moreover, if accessing funds needed to happen immediately in the face of a catastrophic expenditure, Uulala’s peer-to-peer platform would easily be able to accommodate this type of request in both Spanish and English in order to better serve the Latino community.

Uulala has also partnered with HoyHealth, another social impact driven company, focused on providing discounted FDA approved medication access and telehealth services to meet the needs of the Latino community in the US and Puerto Rico.

The diversity in the Latino community means that addressing their healthcare issues is going to take innovative, groundbreaking solutions. The healthcare providers who understand this community’s diverse needs and their cultural practices are poised to attract the more than 50 million Latinos who live in the United States.

That said, the ability to receive money seems to play a crucial role in improving access to health care for this segment of the population. They enable people who require an unexpected visit to the doctor or hospital to make use of money transfers from friends or family instead of cutting back on essentials such as food, education, or other areas of core spending.

Uulala will continue to expand its services to Latino communities throughout the United States and Mexico, tying more consumers of all income levels into the digital economy. There is no question about that. But the promise of improving access to healthcare services via mobile payments is still unfolding – one with more than a few positive signs, and closer than ever to being a certainty.

Commitment to Impact

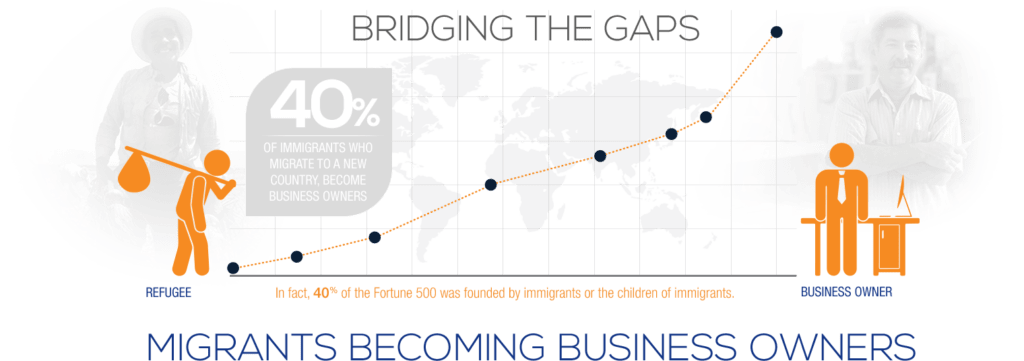

Uulala, Humanity 2.0 and The Laudato Si’ Challenge have partnered to build a new model of borderless financial security and access. The objective is to positively and sustainably impact the lives of 10 million migrants and refugees by 2020.