In a new report by Sifted, the H1 2024 European Startups Review provides a comprehensive analysis of the European startup landscape during the first half of the year.

The report reveals that, despite a broader venture capital slowdown, certain sectors—particularly Climate Tech—are not just surviving but flourishing.

It also highlights a significant increase in public funding, which is playing a crucial role in supporting startups driving social impact across the continent.

Key Figures from the Report

Biggest Deals

- Northvolt: The Swedish battery manufacturer secured a massive €5 billion in funding, making it the largest deal of H1 2024.

- H2 Green Steel: Another Swedish company, H2 Green Steel, followed closely with €4.75 billion in funding.

- SumUp: The UK-based payments firm raised €1.5 billion, placing it among the top deals of the first half of the year.

Top Countries for Startup Funding

- United Kingdom: Led the funding race with €13.3 billion, thanks to a record-breaking performance in May.

- Sweden: Close behind with €12 billion in startup funding, driven by mega-deals like those of Northvolt and H2 Green Steel.

- France: Came in third with €6 billion in funding, significantly trailing the UK and Sweden.

Leading Cities for Startup Investment

- Stockholm: The Swedish capital attracted the most funding, securing €10.8 billion in H1 2024.

- London: Just behind Stockholm, London received €10.3 billion in startup investments.

- Grenoble: Surprised many by securing the #5 spot with €1.3 billion in funding.

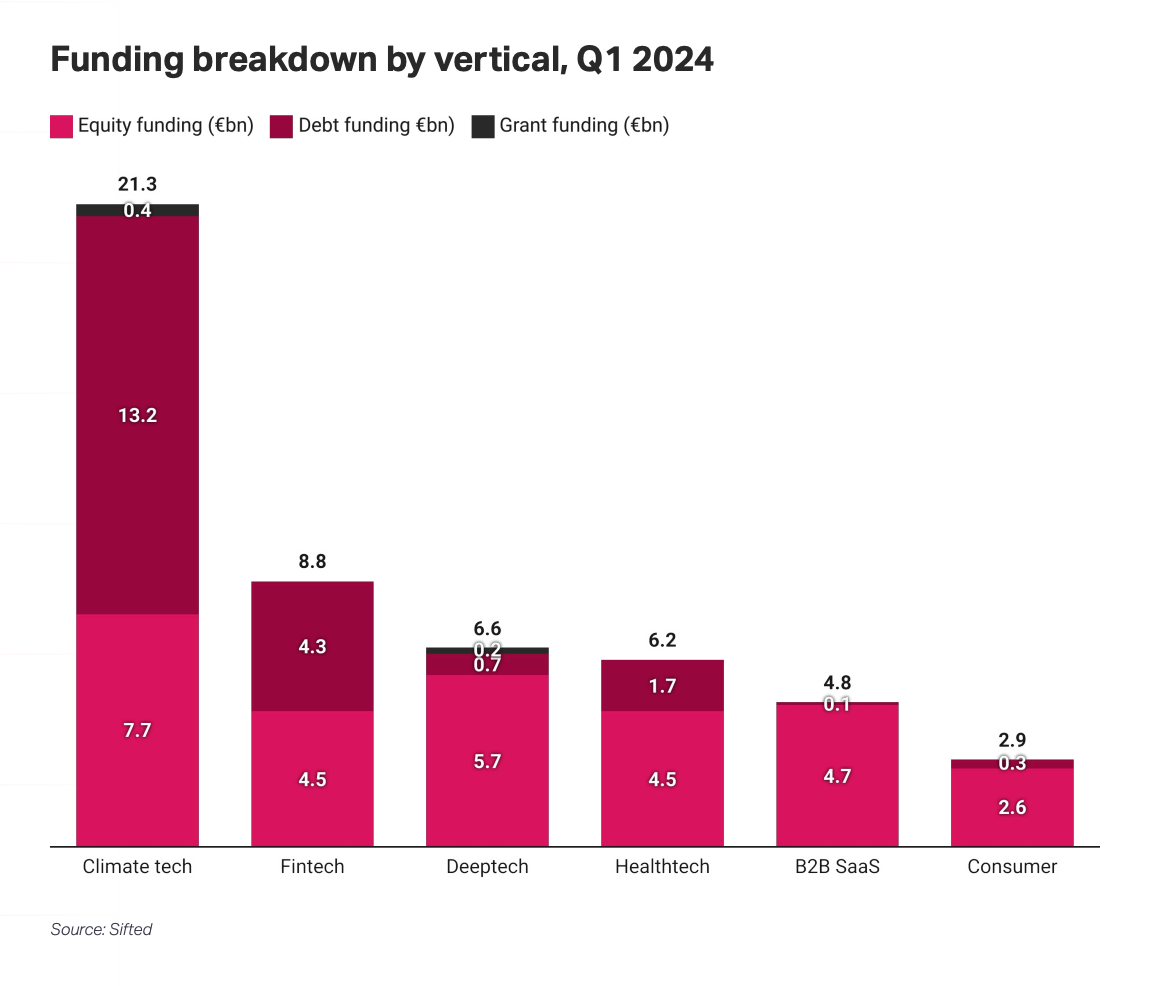

Top Verticals

- Climate Tech: Large growth in the investment landscape with €21.3 billion in funding, primarily due to a few massive debt rounds.

- Fintech: Outperformed Climate Tech in Q2, indicating a strong sectoral competition.

Key Sectors

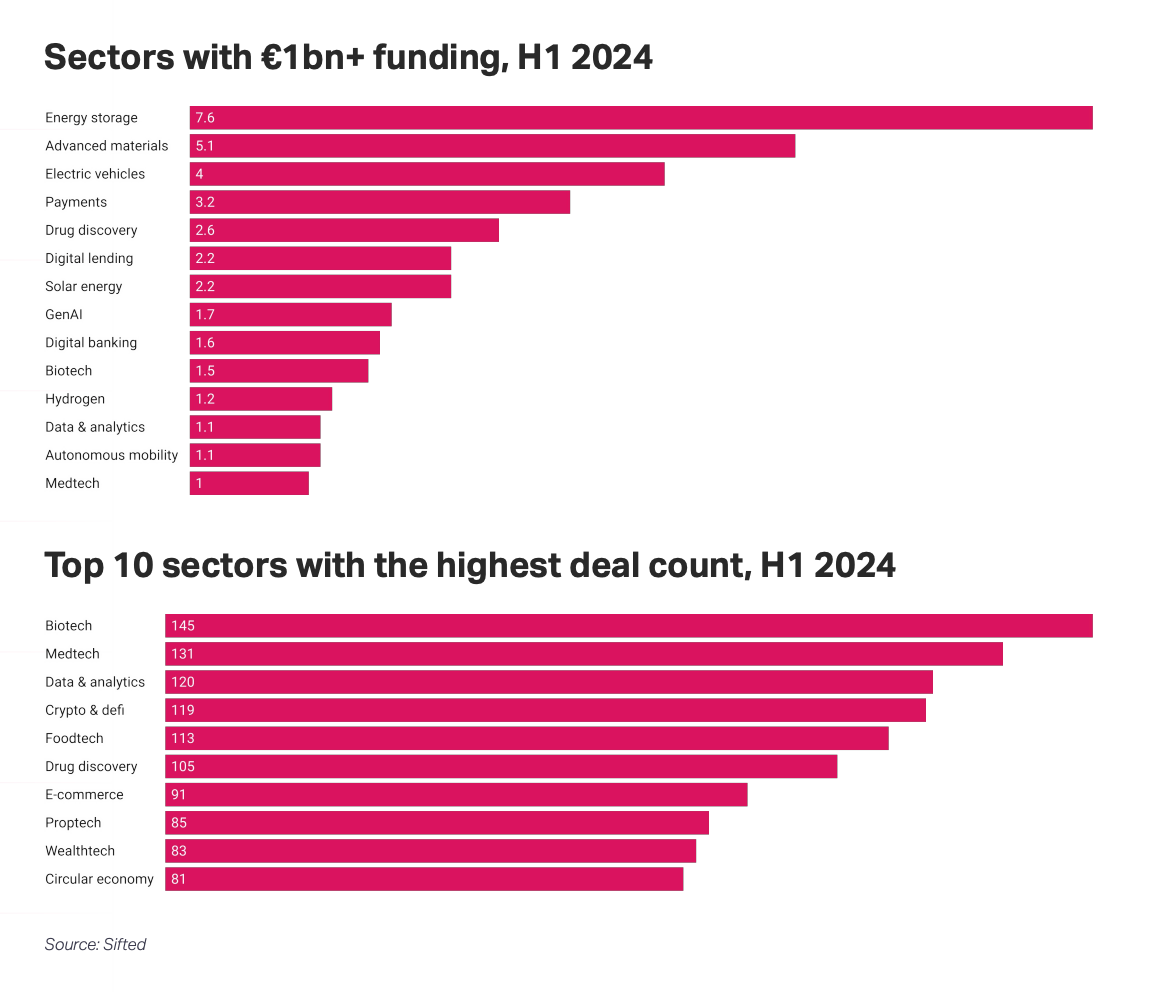

- Energy Storage, Advanced Materials, and EVs: These sectors captured the most attention and investment, reflecting the focus on sustainable technologies.

- Biotech, Medtech, and Data & Analytics: These sectors topped the charts in deal count, indicating high investor interest in healthcare and data-driven technologies.

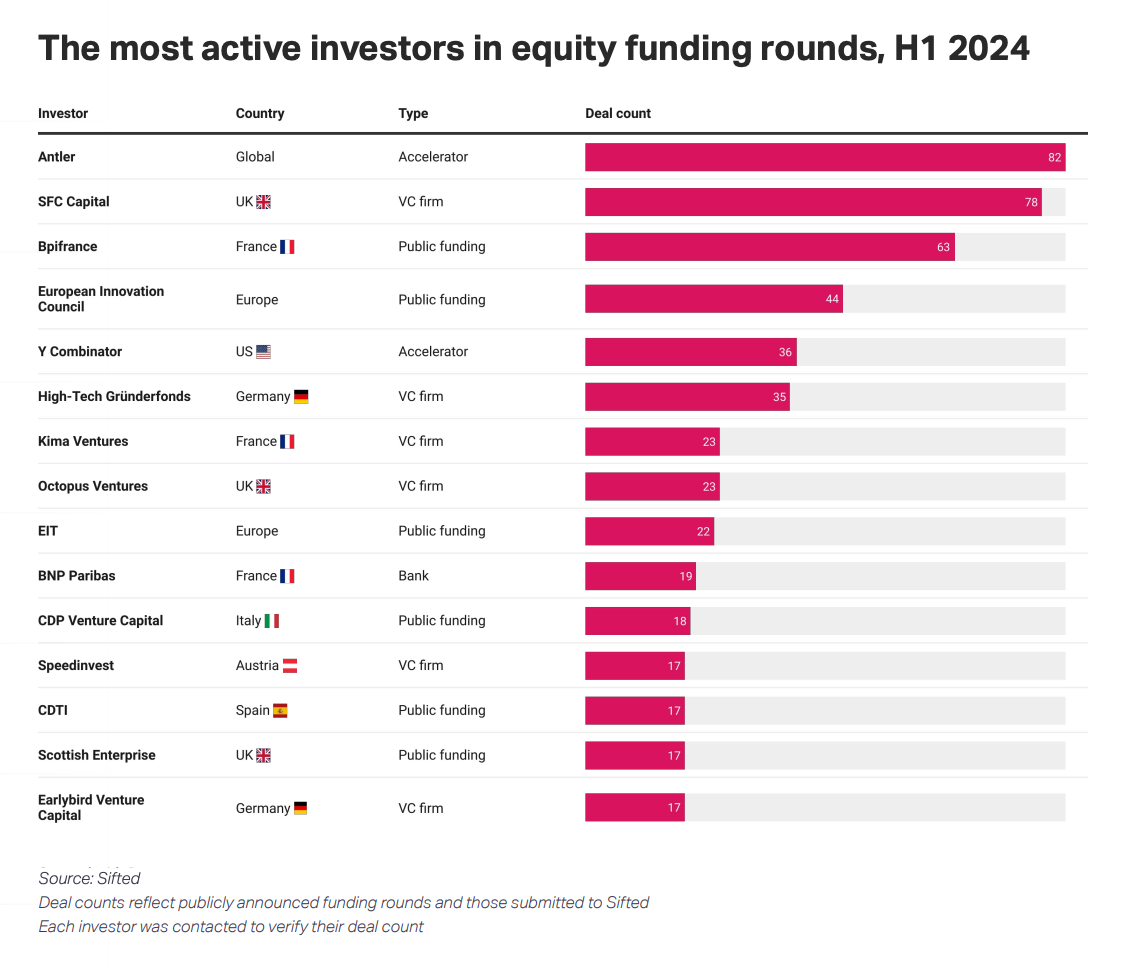

Most Active Investors

- Antler: The global accelerator was the most active investor in Europe, with 82 investments in H1 2024.

- SFC Capital: Followed closely with 78 investments.

- European Investment Bank: Led in debt financing, making 7 deals in the first half of the year.

Climate Tech Growth Amidst Economic Uncertainty

One of the standout sectors in the report is Climate Tech, which has shown growth despite the economic challenges of the year.

With the urgency of climate change at the forefront, investors are increasingly channeling their capital into startups offering innovative solutions in renewable energy, carbon capture, and sustainable agriculture.

Northern Europe, particularly the Nordic countries, has emerged as a leader in Climate Tech innovation.

Companies like Northvolt and OX2 have secured significant funding rounds, underscoring strong investor confidence in their potential to drive meaningful environmental impact.

Public Funding: A Critical Lifeline for Startups

In an environment where venture capital is increasingly difficult to secure, public funding has become a critical lifeline for startups.

Governments across Europe, along with EU-level initiatives, have introduced a variety of funding programs designed to sustain startup growth during these challenging times.

These programs include direct grants, subsidies, and loan guarantees, many of which are specifically tied to impact metrics such as sustainability, job creation, and digital inclusion.

The report points to a notable surge in public funding, particularly in sectors like Climate Tech and health tech. With a strategic focus on impact, these funds are increasingly being directed toward startups that can demonstrate clear social benefits.

This trend reflects a broader shift in the European startup ecosystem towards impact-driven investment, where financial returns are complemented by positive social and environmental outcomes.